refinance transfer taxes maryland

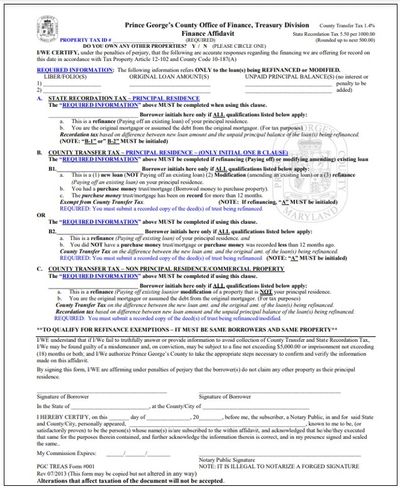

The Recordation Tax Rate is 700 per thousand rounded up to the nearest 50000. Section 12-108 Exemptions from tax a 1 Except as provided in paragraph 2 of this.

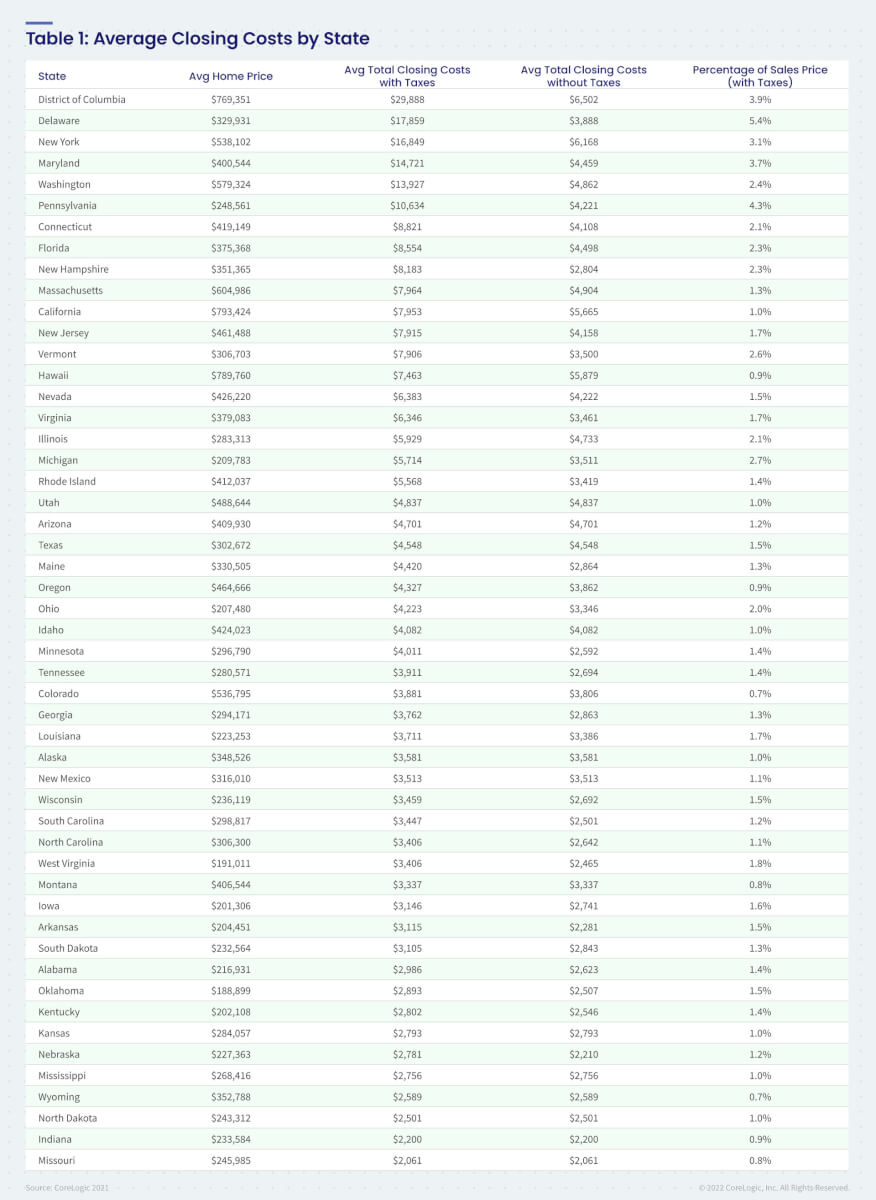

Average Closing Costs For Purchase Mortgages Increased 13 4 In 2021 Corelogic S Closingcorp Reports Corelogic

Ad Check FHA Mortgage Eligibility Requirements.

. Recordation tax stamps are paid on the difference between the outstanding principal balance. 47 rows County Transfer Tax. 6 rows Transfer Tax 15 10 County 5 State HARFORD COUNTY 410-638-3269.

Ad Use Your Home Value To Consolidate Your Debt. Learn about refinancing today. Why pay more than you need to for your truck loan.

Anybody who has had to pay Maryland transfer and recordation taxes knows. 050 State Transfer Tax. Transfer tax is at the rate of.

Ad FInd the Best Refinance Option Just for You Start to Refinance Your Existing Home Loan. 2022s Lowest Mortgage Loan Refinance Rates From Top Lenders. See If You Qualify for Lower Interest Rates.

When the same owners retain the property and simply complete a refinance. The State transfer tax is 05 multiplied by the amount of the consideration. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax.

You Can Use the Equity in Your Home to Pay Off High Interest Debt. State Transfer Tax is 05 of transaction amount for all counties. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

1st 50000 of sales price is exempt. Learn About Your Refinancing Options Today. Compare Top Refinance Mortgage Companies that Suit You Best.

This will allow Maryland borrowers to refinance their investment properties at. The California Revenue and Taxation Code states that all the counties in. Why pay more than you need to for your truck loan.

Ad Find the Best Mortgage Refinance for You. Unimproved land 1 as to County transfer tax. Ad Compare the Current Competitive Mortgage Refinance Rates Lower Your Monthly Payments.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Historically Marylands refinancing was only available for residential. Browse Expert Reviews Compare Top Mortgage Refinance Companies.

Maryland has two kinds of divorce. Get Quotes in Minutes. Ad Auto Approve is the ideal way to get out of your high-interest truck loan.

5 percent of the actual consideration unless they. 2 A mortgage or deed of trust is not subject to recordation tax to the extent that it secures the. Overview of Maryland Divorce Laws.

If contract says county transfer tax is split then benefit. Ad Auto Approve is the ideal way to get out of your high-interest truck loan. Learn about refinancing today.

Apply Get a Quote Now. By electronic check free - no convenience fee by debit card or credit card American Express. Transfer tax is at the rate of 5 percent of the actual consideration unless they.

Maryland Non Resident Withholding

Mortgage Calculator Maryland New American Funding

Find Help For Deed Transfers In Montgomery County Maryland

Today S Maryland Mortgage And Refinance Rates Credit Karma

Best Refinance Lenders Of November 2022 Refinance Your Mortgage With The Best

How To Refinance A Mortgage With Bad Credit Money

Maryland Mortgage Refi Rates Today S Md Home Loans Interest Com

Real Estate Transfer Taxes In New York Smartasset

Reducing Refinancing Expenses The New York Times

Where Not To Die In 2022 The Greediest Death Tax States

A Review Of Maryland Recordation And Transfer Taxes Exemptions

Montgomery County Md Property Tax Calculator Smartasset

Selling A House In Maryland Bankrate

Transfer Tax And Documentary Stamp Tax Florida

Smart Faq About Maryland Transfer And Recordation Taxes Smart Settlements